10 Dude Friendly Recipes That #SpreadTheMustard

Hey Dad! #SpreadTheMustard with these 10 dude friendly recipes for father's day.

Read More...Watch this video

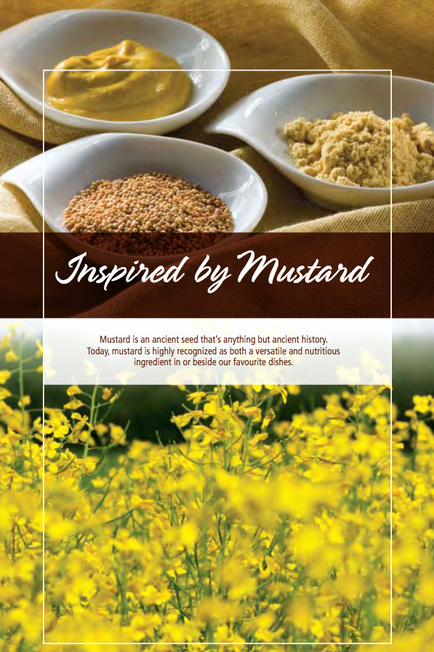

There are endless combinations when creating a prepared mustard and these are just a few of our favourites. #SpreadTheMustard

Try this recipe

Smoked Salmon Crostini with Dill Mustard Cream Cheese

These smoked salmon crostini make a stunning yet simple appetizer that everyone will love. Toasty baguette slices are smeared with a dill and mustard cream cheese, then topped with pickled cucumbers and slices of smoked salmon. Perfect for parties or light lunch nibbles.

@SpreadTheMustard